Smartphone payments become simpler when every tap earns reward points, protects data, and avoids surprise fees.

The Line Pay Card offers these perks through a prepaid model that works both online and in-store in Japan.

How the Line Pay Ecosystem Works

Line Pay resides within the standard Line messaging app, transforming your handset into a secure, contactless wallet. Load funds once, called “charging”, then spend that balance anywhere JCB or Visa is accepted, depending on regional partnerships.

Because the card is prepaid, you never borrow money or pay interest; you simply spend the amount already deposited.

What Sets the Line Pay Card Apart

These unique traits separate the card from ordinary prepaid options and traditional credit lines.

- Prepaid structure eliminates the risk of debt or overdraft charges.

- The digital version activates immediately after approval for quick access.

- A physical card is optional, providing budget control to parents or travelers.

- Compatibility with Android and iOS keeps the setup friction-free.

- Worldwide acceptance at JCB- or Visa-enabled merchants expands usability beyond local markets.

Core Benefits at a Glance

Every feature targets speed, convenience, or tangible savings for daily transactions.

- Cash-back points on every eligible purchase accumulate automatically inside the Line wallet.

- Zero annual fees mean no ongoing cost for holding the card.

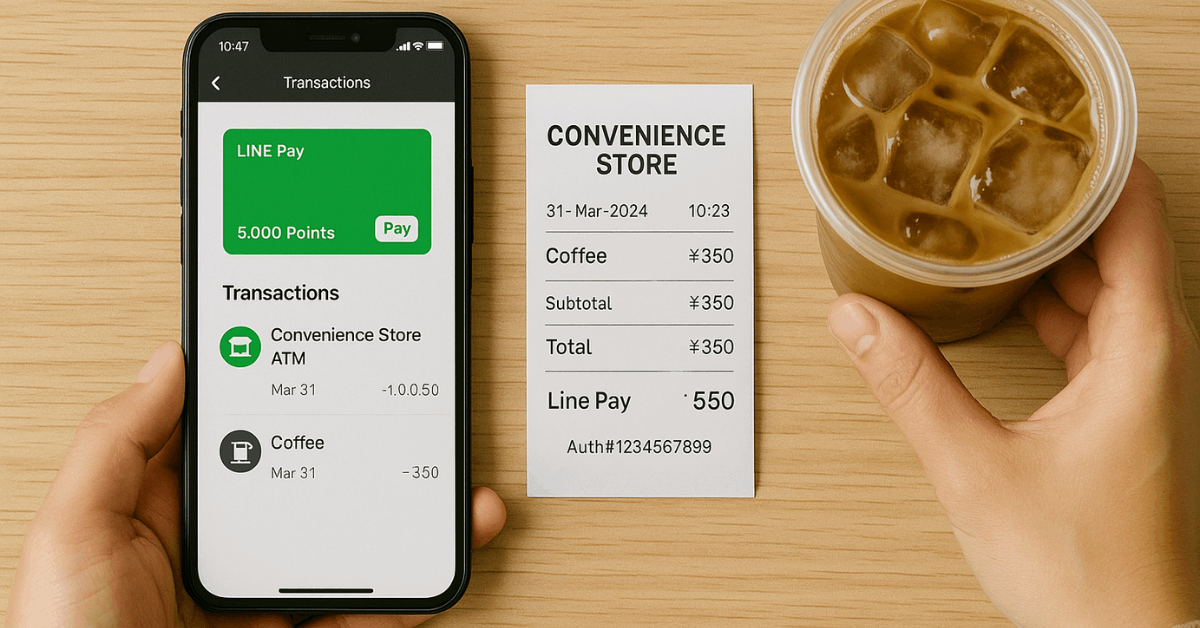

- Real-time transaction tracking inside the app supports better budgeting.

- In-app promotions unlock limited-time discounts with partner stores worldwide.

- No credit check required, so anyone with a verified Line Pay account can apply.

- Smartphone payments remove the need to carry a physical wallet.

Essential Pre-Application Checks

Make sure you have the following before you apply:

- Update the Line app to the latest release for smoother form loading.

- Keep a government-issued photo ID within reach for identity validation.

- Connect to a reliable internet source to avoid timeout errors.

- Confirm the Line Pay profile shows “verified” status before starting the application.

- Recheck name, address, and contact details against official documents.

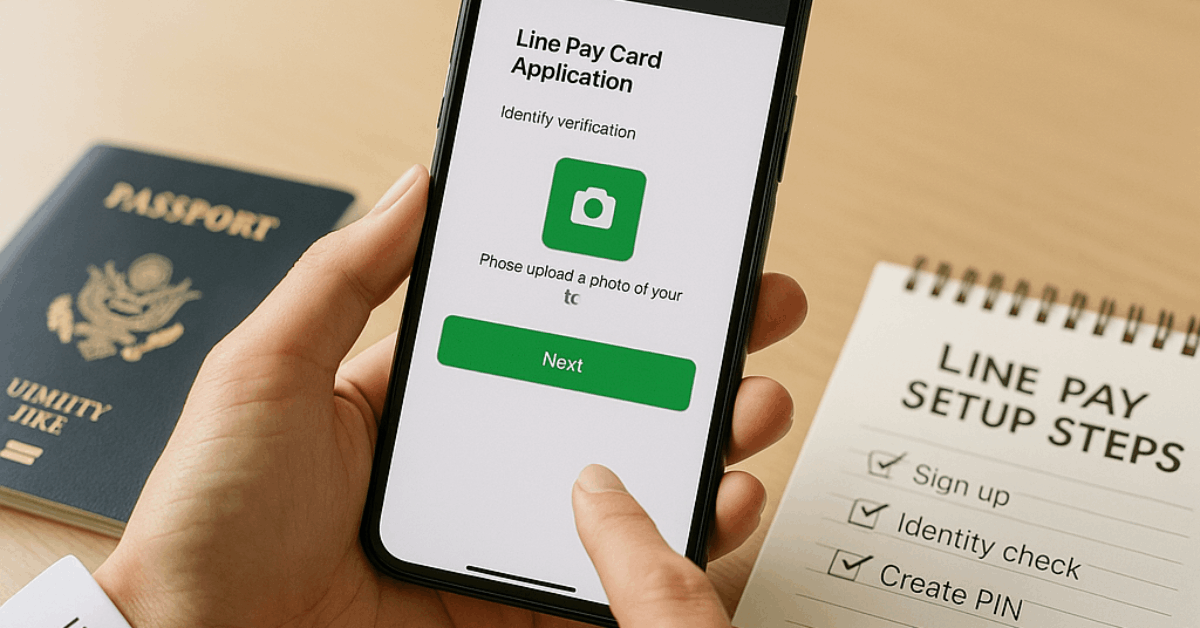

Step-by-Step Application Guide

Follow these six steps on a single smartphone session, and expect approval within minutes in most regions.

- Open the Line app, tap Wallet, and ensure that the basic setup is complete.

- Select Line Pay, then hit Pay to begin the card request.

- Read the full Terms & Conditions and agree to continue.

- Enter personal data, upload the ID photo, and finish identity checks.

- Await confirmation; once approved, the digital card appears instantly in your wallet.

- Set a secure six-digit password, activate the card, and start spending or request a physical version for chip-and-pin purchases.

Costs, Fees, and Interest Rules

Knowing potential charges lets you budget accurately and compare with alternative wallets.

Standard User Fees

Line Pay imposes no fees for registration, activation, or domestic purchases.

Foreign transaction or ATM withdrawal charges can appear, varying by issuing region. Because the card is prepaid, interest never accrues, removing worries about rising balances.

Merchant Pricing Structure

Business owners pay a 3 percent Merchant Discount Rate, excluding tax, on transaction totals. No setup, integration, or monthly platform fees apply, keeping entry barriers low for small enterprises.

Security Framework: Five Layers Guarding Your Money

Robust safeguards reassure users who hesitate to store funds on mobile devices.

- Mandatory ID verification stops impersonation before accounts go live.

- A payment-specific password adds an extra layer of security beyond phone security.

- Industry-standard encryption shields personal and financial data.

- Real-time monitoring flags unusual spending patterns for review.

- Compensation coverage refunds verified fraud up to regional limits when incidents are reported promptly.

Compliance with PCI DSS and ISO/IEC 27001 reinforces these measures, matching global banking standards.

Spending Anywhere: In-Store, Online, and Peer Transfers

Multiple payment modes keep the card handy during grocery runs, streaming subscriptions, or quick bill splits.

- In-store code scan: Display your wallet barcode and let staff scan, or scan the merchant QR code yourself.

- Online checkout: Choose Line Pay at the payment screens to skip manual card entry.

- Peer transfers: Send or request funds inside chat threads once Line Pay is upgraded from Cash to Money status.

Availability of services can differ by jurisdiction, so verify local support inside the app.

Charging and Managing Your Balance

Bank transfers, convenience store kiosks, and select ATMs deposit money into the wallet. Balance, recent transactions, and earned points all appear on a single dashboard, helping you adjust budgets in real time.

Sending or Requesting Money

Request a chosen amount inside the chat, and friends using Line Pay can settle instantly. Withdrawals to bank accounts incur small regional fees; check current rates in the help section.

Merchant Program

Accepting Line Pay can boost basket totals by courting mobile-centric customers.

- Immediate visibility among millions of Line users worldwide.

- In-app promotion slots to spotlight deals or seasonal campaigns.

- Straightforward API documentation for e-commerce integration.

- Countertop QR codes for brick-and-mortar outlets within hours of approval.

- Dedicated merchant support teams solve onboarding or settlement queries.

Fast settlements and brand trust shorten checkout queues, improving customer satisfaction.

Comparing Line Pay Card Against Other Wallet Options

Side-by-side perspective clarifies why the 2 percent point rate often outshines rival prepaid or e-money offers.

| Feature | Line Pay Card | Major Prepaid Competitor | Standard Credit Card |

| Annual fee | None | None | ~JPY 1,500 equivalent |

| Point rate | 2 % | 0.5–1 % | 1–1.5 % on average |

| Cash conversion | Allowed | Usually blocked | Rarely allowed |

| Interest | Not applicable | Not applicable | 15–20 % APR common |

Rates in the table reflect typical ranges and can shift with promotions or policy updates.

Practical Tips for Safer, Smarter Use

Small habits strengthen security and maximise point earnings without extra effort.

- Create a 12-character login password for Line that contains symbols and numbers.

- Change both login and payment passwords every quarter.

- Disable auto-charge to maintain conscious spending limits.

- Monitor promotional banners inside the wallet for limited-time point multipliers.

- Keep push notifications on so transaction alerts catch fraud early.

Conclusion

Line Pay Card combines cash-back rewards, zero interest, and robust security in one mobile wallet, making it a practical choice for budget-minded users in Japan.

The application is quick, fees are transparent, and spending control stays firmly in your hands because every yen, dollar, or euro is prepaid rather than borrowed.

Disclaimer: Product terms, merchant acceptance, and promotional rates can change without notice. Always confirm the latest conditions on the official Line Pay website or inside the app before committing funds.